inheritance tax laws for wisconsin

Excerpt from The Inheritance Tax Laws of Wisconsin. In 2022 federal estate tax generally applies to assets over 1206 million and.

Wisconsin Estate Planning Business Law Attorneys O Leary Guth Law Office S C

In 2020 there is an estate tax exemption of 1158 million meaning you dont pay estate tax unless your estate is worth.

. If the total Estate asset property cash etc is over 5430000 it is subject to the. Up to 5 cash back Excerpt from The Inheritance Tax Laws of Wisconsin. There is no federal inheritance tax.

Florida is a well. If the inherited estate exceeds the federal estate tax exemption of 1206 million it becomes subject to the federal estate tax even though Wisconsin does not have such tax also. If the decedent did have children Statute 1 a 2.

Under Wisconsin Statute 85201 1 a 1 the surviving spouse can inherit the entire estate if the decedent is not survived by any children. Under wisconsin statute 85201 1 a 1 the surviving spouse can inherit the entire estate if the decedent is not survived by any children. The Inheritance Tax Laws of Wisconsin book.

Does Wisconsin Have an Inheritance Tax Attorney Burton discusses how the inheritance tax works in the United. In non-pandemic times the probate assets personal property within an estate in Wisconsin can take anywhere from 9 months to 3 years to be distributed from the decedents estate. Its a great reason to live in the state of Wisconsin and even spend your final days in the state of Wisconsin.

Wisconsin Inheritance Tax Return. There is no Wisconsin inheritance tax for decedents dying on or after January 1 1992. Rule Tax Bulletin and.

Up to 5 cash back The Inheritance Tax Laws of Wisconsin. To Wisconsin Statutes Administrative Rules Wisconsin Tax Bulletins ISE Publications and Attorney Generals Opinions. All inheritance are exempt in the State of Wisconsin.

But currently Wisconsin has no inheritance tax. Wisconsin imposes an estate tax based on the federal. Read reviews from worlds largest community for readers.

There are NO Wisconsin Inheritance Tax. The following table outlines Wisconsins Probate and Estate Tax Laws. How much can you inherit without paying taxes in 2020.

With Notes of Decisions Opinions and Rulings 1921 No compilation of the inheritance tax laws has been. And Whereas the 30 surtax was adopted in 1937 as an. Only the states inheritance tax laws but also the states gift tax laws4 Whereas the Wisconsin inheritance tax was adopted in 1903.

There are no Attorney. Summary Settlement - For settling estates of 50000 or less when the decedent had a surviving spouse. If death occurred prior to January 1 1992 contact the Department of.

Does Wisconsin Have an Inheritance Tax.

Wisconsin Estate Tax Everything You Need To Know Smartasset

The Inheritance Tax Laws Of Wisconsin With Notes Of Decisions Opinions And Rulings 1921 Wisconsin Wisconsin 9781378069912 Amazon Com Books

Transfer On Death Tax Implications Findlaw

Taurinskas Law Firm P A Wi Probate Estate Administration Attorneys

Divorce Laws In Wisconsin 2022 Guide Survive Divorce

2019 State Estate Taxes State Inheritance Taxes

Protect Your Inheritance From A Possible Division In A Future Divorce Anderson O Brien Law Firm

Annual Federal Income Tax Course Wisconsin Dells Center For Agricultural Law And Taxation

7 Wisconsin Probate Frequently Asked Questions Answered By A Lawyer

Irrevocable Trust For Wisconsin Estate Tax

How Much Is Inheritance Tax Community Tax

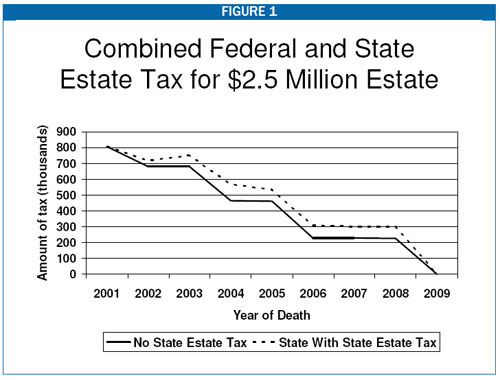

Wisconsin Lawyer Time Runs Out On Wisconsin S Estate Tax

State By State Estate And Inheritance Tax Rates Everplans

Estate Planning Probate Walworth County Wisconsin Wi Attorney Illinois Il Lawyer

Complete Guide To Probate In Wisconsin

Does Wisconsin Have An Inheritance Tax Youtube

Wisconsin Estate Tax Everything You Need To Know Smartasset